Capitalisms Invisible Dark Hands

In 2003, the U.S. Congress began an investigation into suspected money-laundering activity by Riggs Bank. Established in 1836, Riggs is a Washington-based bank that has had 17 U.S. presidents as its customers.

Americans were taken aback by the investigation outcome. The bank had been involved in money laundering for corrupt politicians. The bank had been managing then-Chilean President Augusto Pinochets hundreds of millions of dollars of assets in 28 accounts. The customer information written in the accounts read: A retired expert who accumulated his assets for retirement in a legitimate manner throughout his life after reaping great successes in a specialized area.

This book analyzes a variety of illegal, dirty transactions conducted in the shadow of capitalism. The author Raymond Baker is an economist at the Brookings Institute and has worked in the industry for 40 years in some 60 countries. Based on his ample experience in international business, he boldly sheds light on shameful aspects of capitalism.

The author says that todays capitalism, which appears to be the most efficient system, has three Achilles heels: illegal capital, poverty, and distorted philosophies.

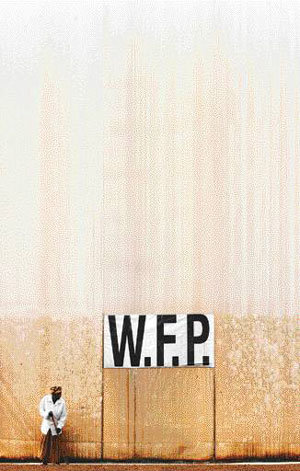

Illegal capital generated from fabricated transactions, bogus companies, and tax evasion make up almost half of the entire amount of capital traded in the world. The author says that Riggs is not alone in being involved in embezzlement, fraud, manipulation of business results, underestimation of assets and breach of trust. Major financial institutions, including Citigroup, JP Morgan, Bank of America, are no exception. In particular, he says that the outflow of the illegal capital of despots and capitalists deepens poverty and hunger in the third countries. The problem is that Western countries, including the U.S., do not punish such behavior. That is because the dark profits enjoyed by corrupt politicians and businessmen give large profits to the Western financial community.

However, the author is not against capitalism. He argues that capitalism needs to be reformed because capitalism without principles and fairness causes bipolarization, terrorism and anti-globalization. He says that distortion of capitalism began when Jeremy Benthams ideas, which justify the sacrifice of a few for the benefit of many were mixed with the Adam Smiths capitalism, which attempts to add morality to capitalism. Therefore, he offers that the world should drop laissez-faire capitalism and that the World Bank should intervene in financial areas for poverty reduction.

The original title of the book written in 2005 is Capitalisms Achilles Heel.

polaris@donga.com