U.S. hedge fund Elliott renews pressure on Hyundai Motor Group

U.S. hedge fund Elliott renews pressure on Hyundai Motor Group

Posted November. 15, 2018 07:44,

Updated November. 15, 2018 07:44

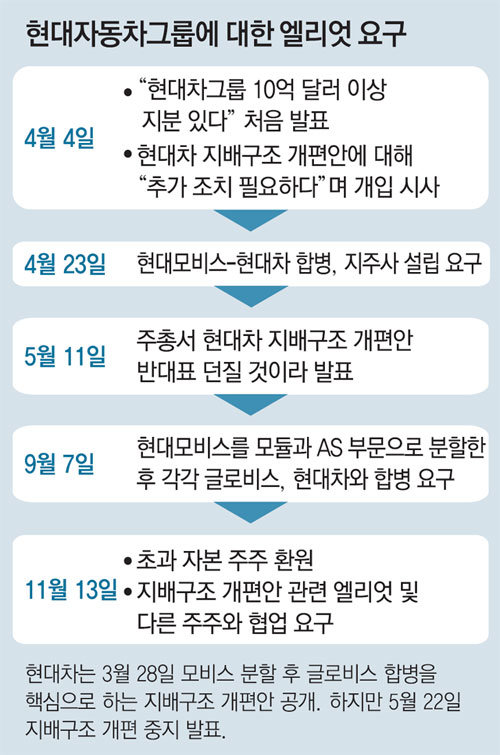

U.S. hedge fund Elliott on Tuesday renewed its pressure on South Korea’s Hyundai Motor Group, demanding that the Korean conglomerate use its capital and assets to recover shareholder losses. The fund has resumed its action on Hyundai, as the automaker’s reform of its governance structure will likely be delayed.

Elliott Advisors (HK) Ltd., a unit of the activist hedge fund, said in a statement on Tuesday night that it sent a letter to the board of directors of Hyundai Mobis Co., Hyundai Motor Co. and Kia Motors Corp. -- all affiliates of Hyundai Motor Group – demanding that the automotive group return excess capital to shareholders and improve its governance structure. Following Hyundai Motor Group’s halting in May of its governance structure reform, Elliott demanded in September that Hyundai Mobis be split up and merged with Hyundai Glovis and Hyundai Motor, respectively. Hyundai did not comment on Elliott’s renewed pressure.

Elliott urged Hyundai to return excess capital to shareholders, claiming that the automotive group is “grossly overcapitalized” with excess capital ranging from 8 to 10 trillion won (7.1 to 8.8 billion U.S. dollars) for Hyundai Motor and from 4 to 6 trillion won (3.5 to 5.3 billion dollars) for Mobis. Elliott said it wants Hyundai Motor Group to shareholders “preferably in the form of share buybacks given the deep valuation discounts.”

The fund also called on the group to “conduct a strategic review of any and all non-core assets,” suggesting that Hyundai sell off its real estate assets in the Global Business Center in southern Seoul.

Elliott also demanded that the group reform its governance structure, criticizing the carmaker for failing to communicate with shareholders over its governance reform since the withdrawal of the original plan. The fund urged the group to “engage with Elliott and other shareholders on governance improvements, including the addition to (Hyundai Motor Group’s) respective boards of new independent directors.”

The local auto industry insiders view that the U.S. fund is demanding the capital return due to its losses from declines in the Hyundai Motor Group’s share prices. On April 4, when Elliott first announced its ownership of the group, Hyundai Motor Co.’s share price was 156,500 won (138.07 dollars). On Wednesday, the stock price closed at 101,500 won (89.55 dollars). Bloomberg estimated Elliott’s loss at some 500 million dollars on the assumption that its stakes in Hyundai Motor remains unchanged.

Hyundai Motor Group plans not to rush its governance reform, based on its judgment that it is hard to make a new attempt because its July-September operating profits tumbled 76 percent year-on-year and unless the risk of the United States’ levying of a 25 percent tariff is not addressed. Some analysts project that Hyundai could postpone its reform to next year. “

It seems that Elliott is attempting to gain a vantage point in a possible shareholders meeting (on governance reform) by persuading other Hyundai Motor Group shareholders first,” said Kang Sung-jin, a researcher at KB Securities Co.

Hyoun-Soo Kim kimhs@donga.com

Headline News

- Joint investigation headquarters asks Yoon to appear at the investigation office

- KDIC colonel: Cable ties and hoods to control NEC staff were prepared

- Results of real estate development diverged by accessibility to Gangnam

- New budget proposal reflecting Trump’s demand rejected

- Son Heung-min scores winning corner kick