Memory chip businesses suffer the worst downturns

Memory chip businesses suffer the worst downturns

Posted January. 31, 2023 07:50,

Updated January. 31, 2023 07:50

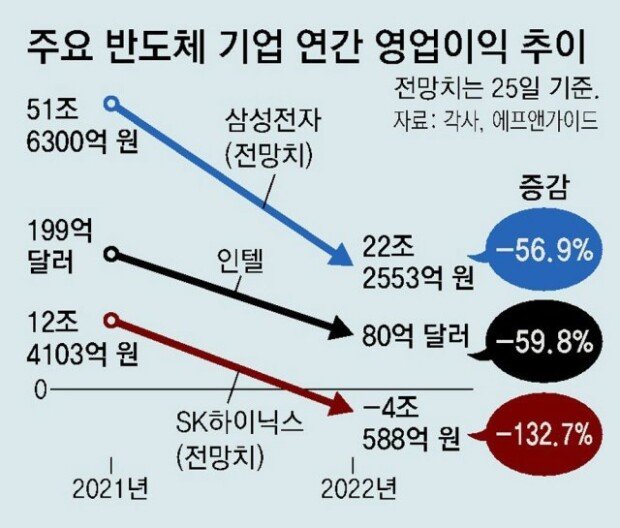

Bloomberg reported on Sunday that a historic crash for memory chips, the business where South Korean companies have championed, hit the industry hard, rendering the businesses to suffer an unprecedented downturn. Experts say the combined operating losses of the players, including Samsung Electronics, Co., and SK hynix, will amount to as high as five billion dollars.

Memory semiconductor companies increased supply as the use of information technology (IT) devices surged during the Covid-19 pandemic entering a boom cycle. However, as demand has plummeted, they have been suffering from overstocking. As inventory for three to four months reaches a record high, prices plummet, and corporate losses are increasing.

While the memory-chip sector is known for its boom-and-bust cycles, this time the bust seems unnerving, according to industry experts. “We’ve seen extraordinary measures within the memory market in terms of reductions, not only in spending, but also cuts and fab utilization, and in some cases, even delays of technology investments,” Lam CEO Tim Archer recently said on a call with investors. “We also see memory as a percent of the total WFE mix that's at levels that we haven't seen in 25 years.”

The size of the global memory chip market is around 160 billion dollars. The chip-makers are tightening their belt to get through the tough time, even going for employee cuts. At the end of last year, Micron announced the prospect for the first quarter of the year’s operating losses and said it plans to cut 10% of its employment size. Lam Research is also seeking a 7% employee reduction.

Hyoun-Soo Kim kimhs@donga.com · Teuk-Gyo Koo kootg@donga.com

Headline News

- Joint investigation headquarters asks Yoon to appear at the investigation office

- KDIC colonel: Cable ties and hoods to control NEC staff were prepared

- Results of real estate development diverged by accessibility to Gangnam

- New budget proposal reflecting Trump’s demand rejected

- Son Heung-min scores winning corner kick