‘Stress DSR' to be applied from February next year

‘Stress DSR' to be applied from February next year

Posted December. 28, 2023 08:35,

Updated December. 28, 2023 08:35

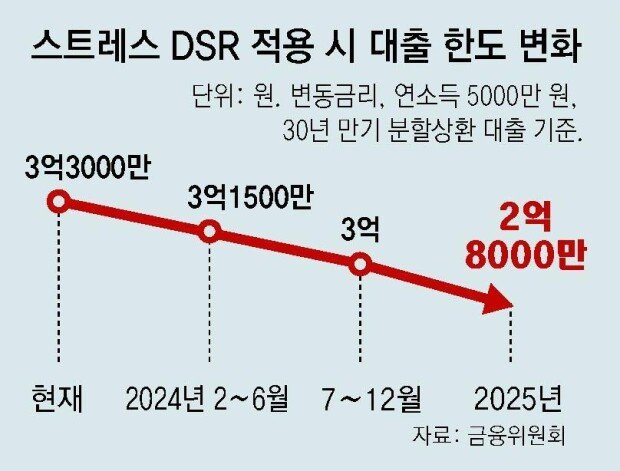

To reduce household debt, which has exceeded 1,800 trillion won (1,390 billion U.S. dollars), financial authorities will introduce 'Stress' debt service coverage ratio (DSR) regulations for loans in the financial sector starting February next year. Effectively immediately on February 26, the limit for new mortgage loans (30-year maturity) for borrowers with an annual income of 50 million won (38,600 dollars) will be reduced by up to 15 million won (11,580 dollars).

The Financial Services Commission announced Wednesday that it will implement the stress DSR system for variable-rate, mixed-rate, and life-cycle loans across all financial institutions starting next year. The idea is to further reduce the lending limit by adding a certain stress interest rate (surcharge) to the existing DSR regulation, which curbs the lending limit based on the ratio of the principal amount to be repaid each year from the borrower's annual income.

The Financial Services Commission calculated the stress rate based on the difference between the highest household loan interest rates in the past five years and the current rate (as of May and November each year). However, in order to ease the financial burden on non-speculative borrowers by reducing loan limits, only 25 percent of the determined stress rate will be added in February next year, 50 percent in the second half of the year, and 100 percent in 2025. In terms of loan products, it will be implemented starting first with mortgage loans in the banking sector in February next year. It will be gradually expanded in phases to credit loans in the banking sector and mortgage loans in the secondary financial sector in June. "The measure is expected to prevent financial borrowers from taking on excessive debt burdens that exceed regulatory levels even if interest rates rise in the future," the financial authorities said.

Seong-Ho Hwang hsh0330@donga.com

Headline News

- Prosecutor General defies resignation, faces impeachment push

- N. Korean provocation by firing ballistic missiles during first ROK-US joint drill

- Grandmoms wear ‘gwajam’ as freshmen at university

- Canada names economist prime minister amid U.S. trade tensions

- Hong Myung-bo calls up young talents to balance with veterans