US Fed signals just one interest rate cut for this year

US Fed signals just one interest rate cut for this year

Posted June. 14, 2024 07:39,

Updated June. 14, 2024 07:39

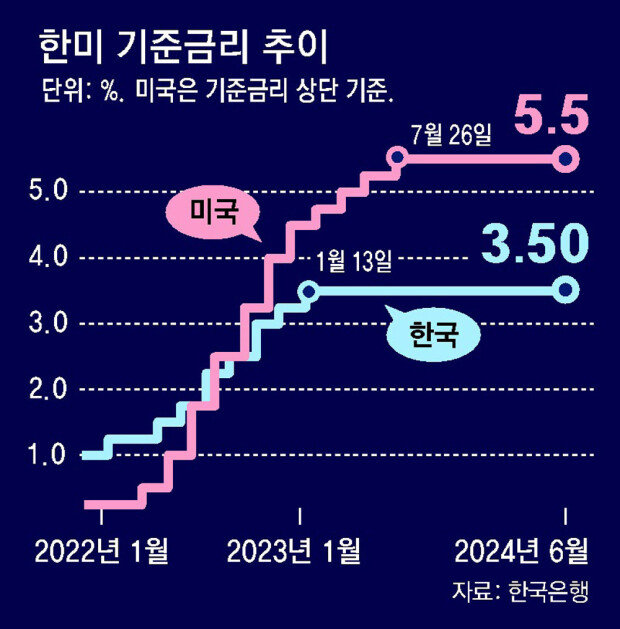

The Federal Reserve, the U.S. central bank, adopted a cautious stance on Wednesday (local time), signaling that it would maintain its benchmark interest rate and introduce just one interest rate cut by the end of the year. In contrast to Europe and Canada's decision to cut their interest rates, the U.S. chose to lower the possibility of an interest rate cut in September and emphasized the importance of maintaining high interest rates.

The Federal Reserve, in its regular meeting of the Federal Open Market Committee on Wednesday, announced that the U.S. benchmark rates will be frozen for the seventh consecutive time and be kept around 5.25 to 5.50 percent. The year-end median rate is 5.1 percent, 0.25 percentage points lower than the current rate. This decision, while reflecting signs of the inflation rate slowing down, such as the growth rate of the consumer price index (CPI) for May being 3.3 percent, lower than the market expectation of 3.4 percent, also signifies a shift in the Federal Reserve's plan from three interest rate cuts to only one interest rate cut, potentially impacting the financial markets and the economy.

"Readings like today's CPI are a step in the right direction. But one reading is just one reading. You don't want to be too motivated by any single data point," Chair of the Federal Reserve, Jerome Powell, said during a press conference on Wednesday. However, he added that two rate cuts are possible, not completely excluding the possibility of a September rate cut. According to FedWatch, a Chicago Mercantile Exchange, investors of the Federal Reserve’s futures lowered their estimated possibility for a September rate cut from about 70 percent after the CPI announcement on Wednesday morning to 60 percent following Powell’s press conference. As the Federal Reserve consecutively froze its benchmark rate, its gap against the South Korean base rate is maintained at up to 2.0 percentage points.

Hyoun-Soo Kim kimhs@donga.com