Third-largest HBM producer Micron expands production lines

Third-largest HBM producer Micron expands production lines

Posted June. 24, 2024 08:06,

Updated June. 24, 2024 08:06

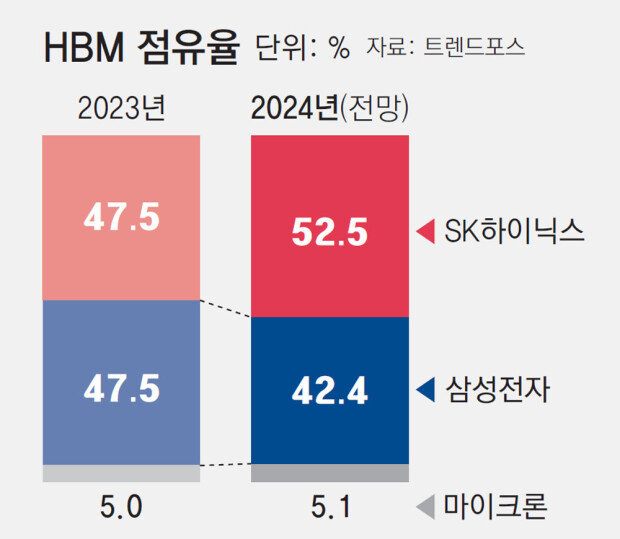

U.S. memory producer Micron, one of the top three leaders along with Samsung Electronics and SK hynix in the global memory market, plans to expand HBM (high bandwidth memory) factory lines in the United States, Taiwan, Japan, and Southeast Asian countries. Such a swift move has been determined with this high-performance memory in higher demand in the growing AI market. Up until last year, Micron only took up five percent of the HBM market. With aggressive investments taking place down the road, there are growing concerns about Samsung and SK securing a weaker presence than anticipated in the AI market.

According to Nikkei Asia on Sunday, Micron has been considering turning its factories in Malaysia into HBM-focused facilities. The factories in question have been responsible for post-processing procedures such as testing and packaging. However, they can be partly upgraded to be dedicated to HBM.

The HBM structure is built around multiple DRAMs stacked vertically to exponentially enhance data processing. “It matters to connect DRAMs sophisticatedly in terms of HBM technology. Thus, Post-processing is as important as pre-processing,” an industry insider said. “In this sense, it can be an efficient strategy to upgrade the post-processing facilities in Malaysia.”

Likewise, it has been reported that Micron intends to expand facilities in Taichung, the largest HBM hub in its production networks. The headquarters in Idaho, the hub for research and development, is beefing up its efforts to invest in researchers and facilities dedicated to HBM. Also, it will fabricate DRAMs for HBM in Hiroshima facilities, which are currently under construction and will tentatively come online in 2027.

By next year, Micron announced its ambitious goal to increase its market share from 5 percent to 20 to 25 percent. It seems determined to turn the tables by making aggressive investments, given that the market share of HBM in the DRAM industry is expected to rise from 8 percent last year to 21 percent this year, going further to more than 30 percent next year.

박현익 beepark@donga.com