Early tax shortage warning with a 9 trillion won deficit

Early tax shortage warning with a 9 trillion won deficit

Posted June. 29, 2024 07:31,

Updated June. 29, 2024 07:31

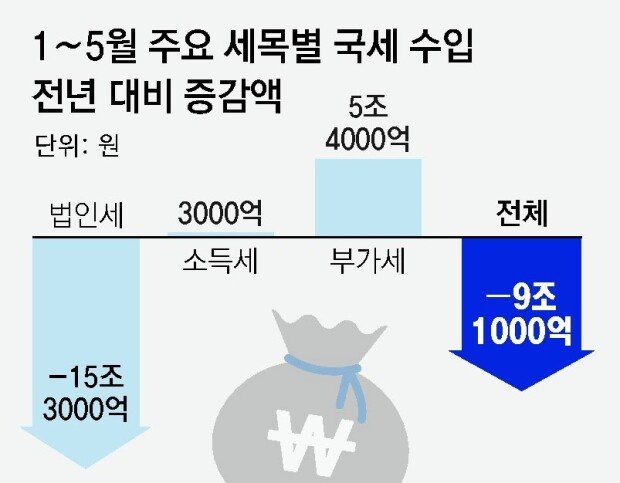

As of May 2024, national tax collection was over 9 trillion Korean won less than the previous year, prompting the government to issue an early warning for low tax revenue. This year's tax collection progression lags by more than 5 percentage points behind the five-year average, leading to the government's re-estimation of 2024 tax revenue, which practically acknowledged the shortage.

According to the Ministry of Economy and Finance's report on June 28, 151 trillion won was collected between January and May 2024, compared to 160.2 trillion won during the same period last year. The collected tax rate is 41.1%, 5.9 percentage points lower than the five-year average of 47%. The government issues an early warning and conducts tax re-forecasting if the collected tax rate falls more than five percentage points below the five-year average.

This marks the second consecutive year of a significant tax revenue drop, prompting the government to issue an early warning. In 2023, a similar situation led to an early warning and a September re-estimation.

In collaboration with the joint tax revenue forecasting committee, the ministry's Tax and Customs Office is actively planning to recalculate the 2024 tax revenue. Any shortfall can potentially be addressed by increasing the volume of unused budget.

The primary reason for the tax revenue shortfall up to May is reduced corporate tax collection. Poor corporate performance since last year has decreased tax revenue by 15.3 trillion won. Notably, top corporate taxpayers Samsung Electronics and SK hynix filed zero corporate tax due to the semiconductor industry's downturn and resulting negative earnings.

세종=조응형 기자 yesbro@donga.com