Generational pension premium hike proposed

Generational pension premium hike proposed

Posted August. 17, 2024 08:00,

Updated August. 17, 2024 08:00

The presidential office is expected to announce a national pension reform plan by the end of this month, focusing on generational equity and sustainability. The proposal aims to shift the contribution structure so that younger generations, who will receive pensions much later, pay less, while older generations, who are closer to receiving benefits, pay more. To mitigate the risk of fund depletion, the government is also considering an "automatic fiscal stabilization mechanism" that would adjust contributions and benefits automatically. According to government analysis, this approach could delay the pension fund's depletion by over 30 years, pushing it beyond the current estimate of 2055.

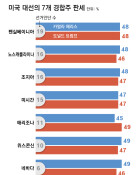

With pension reform discussions stalled in the 22nd National Assembly, the government's move to set a direction is noteworthy. However, the proposal to apply different premium rates by generation is unprecedented globally and is likely to spark debate. For instance, if the current premium rate of 9% is raised to 13%, younger generations might see their rates increase gradually over 10 years, while older generations could face faster hikes within five years, leading to different timelines to reach the final rate. This could provoke resistance from middle-aged and older people who would bear the brunt of steeper increases.

There are also concerns about how generations will be divided, which could fuel intergenerational conflict. Questions arise about whether it is fair to raise premiums more quickly for non-regular workers and the self-employed in their 40s and 50s compared to high-income regular workers in their 20s and 30s. Critics also argue that this approach undermines the fundamental principle of social insurance based on the ability to pay. The government plans to announce the principle of differential increases while leaving the specifics to be hashed out in parliamentary discussions. This strategy recalls last October’s “vague reform proposal” submitted to the National Assembly, which sidestepped sensitive figures.

The proper course would involve the government presenting a concrete, actionable plan, followed by bipartisan discussions and public consultation in the National Assembly to finalize the proposal. An initial agreement on the plan to “pay more,” which was nearly reached in the 21st National Assembly, would be a good starting point. Sensitive issues, such as ensuring generational equity, should be tackled through a phased approach. In pension reform, swift action is as crucial as fundamental changes. Every day of delay costs the pension fund 100 billion won.