More than 10 Korean companies to reach A credit rating milestone

More than 10 Korean companies to reach A credit rating milestone

Posted September. 11, 2024 07:35,

Updated September. 11, 2024 07:35

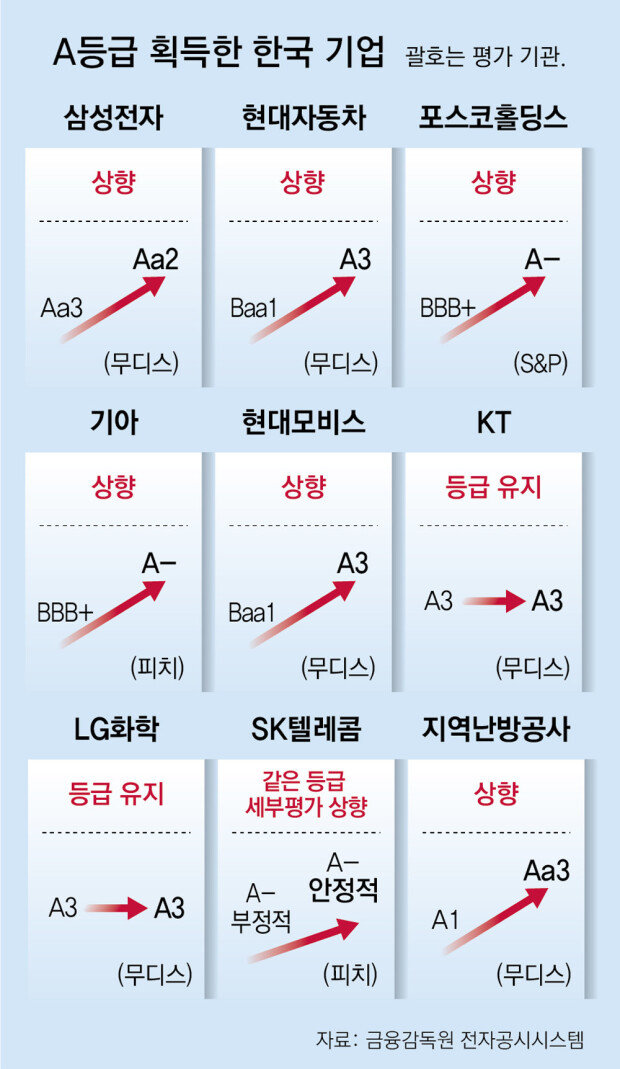

For the first time, the number of non-financial South Korean companies receiving A-grade credit ratings (A-, A3, or higher) from the world's top three credit rating agencies—Standard & Poor’s (S&P), Moody’s, and Fitch Ratings—is expected to exceed the mark of ten. With Hyundai Motor and Kia recently being upgraded to A-grade ratings, the number of South Korean firms rated A during the first half of the year has already reached nine, surpassing the seven companies recorded five years ago. Experts attribute this achievement to the crisis management abilities of South Korean firms amid the pandemic, supply chain disruptions, and geopolitical uncertainties.

An analysis by The Dong-A I lbo on Tuesday of the data from the Financial Supervisory Service's electronic disclosure system showed that as of the first half of 2024, nine companies, excluding financial, insurance, and investment firms, were rated A by the top three credit agencies. Five years ago, this figure stood at seven. The increase is due to upgrades for companies such as Hyundai Motor, Kia, Hyundai Mobis, and POSCO Holdings, which were not rated A at that time.

Considering that perennial A-rated companies such as Korea Electric Power Corporation (KEPCO) and Korea Gas Corporation are scheduled for their evaluations in the second half of the year, it is likely that the number will exceed 10 for the first time. Until now, the number of A-rated South Korean firms has consistently remained below 10, ranging from seven in 2014 to nine last year.

The top three credit rating agencies classify long-term credit ratings into 22 tiers for S&P (AAA to D), 21 for Moody’s (Aaa to C), and 20 for Fitch (AAA to D). An A-grade rating signifies strong debt repayment capabilities, classifying companies as "investment-grade." Obtaining this rating requires a rigorous process that assesses profitability (such as operating profit margins), business portfolio, corporate governance, market position, and transparency, all based on the companies’ fundamental core competitiveness.

Achieving an A-grade rating not only allows companies to issue bonds at lower interest rates but also enhances their brand image and stature. “An A-grade rating not only improves a company’s credibility, allowing it to issue bonds at favorable rates, but also facilitates investment attraction from major international institutions,” said Kang In-soo, a professor of economics at Sookmyung Women’s University.

The upgrades for Hyundai Motor Group are seen as a testament to its strong crisis management capabilities. In 2022, during the global supply chain crisis caused by a shortage of automotive semiconductors, Hyundai Motor and Kia climbed to third place in global vehicle sales for the first time. While competitors like Japan’s Honda faced production and sales declines due to parts shortages, Hyundai Motor and Kia rose in the rankings.

Jae-Hyeng Kim monami@donga.com

Headline News

- Joint investigation headquarters asks Yoon to appear at the investigation office

- KDIC colonel: Cable ties and hoods to control NEC staff were prepared

- Results of real estate development diverged by accessibility to Gangnam

- New budget proposal reflecting Trump’s demand rejected

- Son Heung-min scores winning corner kick