China lowers reserve requirement and interest rates

China lowers reserve requirement and interest rates

Posted September. 25, 2024 07:46,

Updated September. 25, 2024 07:46

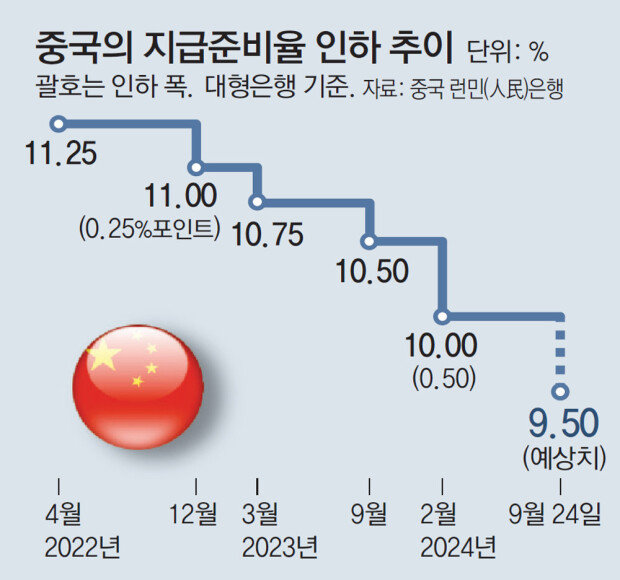

China, grappling with a sluggish real estate market and weak consumer spending, announced on Tuesday that it will lower its reserve requirement ratio (RRR) by 0.5 percentage points, injecting 1 trillion yuan (approximately 190 trillion won) into the market. The country also decided to reduce the interest rate on seven-day reverse repurchase agreements (repos), a key short-term rate, by 0.2 percentage points.

Following the U.S. Federal Reserve's recent “big cut” of 0.5 percentage points last Wednesday, China has launched its own efforts to inject liquidity by cutting both the RRR and key policy rates. With mounting concerns over deflation—characterized by slowing economic growth and falling prices—authorities have ramped up stimulus measures in a bid to meet this year’s economic growth target of around 5%, which now seems increasingly challenging.

Pan Gongsheng, governor of the People’s Bank of China, said in a press conference that the RRR could be cut further by 0.25 to 0.5 percentage points by the end of the year, depending on conditions. Lowering the RRR reduces the amount of cash that banks must hold in reserve, allowing more funds to flow into the market. However, Pan did not specify the timing of any future reductions.

Bloomberg reported that this is the first time in a decade that China has simultaneously lowered both the RRR and key policy rates, underlining the urgency of the government’s stimulus measures. The stronger-than-expected moves led to a more than 3% increase in major stock indices in Shanghai and Hong Kong.

Chul-Jung Kim tnf@donga.com