Korea Housing Finance Corporation faces significant financing default

Korea Housing Finance Corporation faces significant financing default

Posted October. 15, 2024 08:28,

Updated October. 15, 2024 08:28

The Korea Housing Finance Corporation (KHFC) is facing a significant surge in default amounts on its project financing (PF) guarantees, mainly due to the struggles of small and medium-sized construction companies. An example is a construction company in Yangcheon-gu, Seoul, which entered corporate rehabilitation while nearly completing a multi-family housing project. Despite being 88% finished, the company couldn’t cover interest payments and edged toward bankruptcy.

As more developers fail to meet their loan obligations, KHFC's liability in covering these defaults is reaching unprecedented levels.

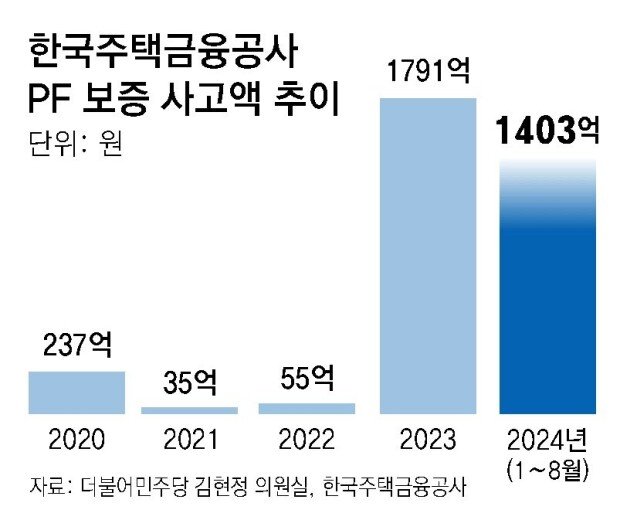

Data provided by Rep. Kim Hyun-jung of the Democratic Party of Korea in the Political Affairs Committee indicates that from January through August this year, KHFC’s default amount on PF guarantees reached 140.3 billion won, which is 78% of last year’s total (179.1 billion won). The corporation’s PF guarantee accident rate also rose to 1.61%, up from 1.44% at the end of the previous year. This default rise is linked to prolonged high interest rates, which have strained small and medium-sized businesses reliant on PF loans.

A PF guarantee is a security KHFC provides to housing businesses, such as construction firms when they take out loans for housing projects. If a company fails to repay its loans, undergoes bankruptcy or rehabilitation, or faces extended construction delays, KHFC covers 70-80% of the loan for the lending financial institution.

Regionally, Seoul accounted for the highest proportion of defaults at 33.5% (47 billion won), followed by Gangwon Province (27.0%) and North Gyeongsang Province (26.5%). This trend reflects the struggles of housing businesses in these areas, with high interest rates and rising construction costs compounding their difficulties. Rep. Kim emphasized the need for KHFC to strengthen its screening and risk management processes in response to the growing number of guarantee incidents.

Financial authorities are also exploring ways to overhaul the domestic PF sector, potentially adjusting the risk weighting on PF loans.

강우석 기자 wskang@donga.com

Headline News

- Joint investigation headquarters asks Yoon to appear at the investigation office

- KDIC colonel: Cable ties and hoods to control NEC staff were prepared

- Results of real estate development diverged by accessibility to Gangnam

- New budget proposal reflecting Trump’s demand rejected

- Son Heung-min scores winning corner kick