Tax-exempt shared offices in rural areas misused as tax havens

Tax-exempt shared offices in rural areas misused as tax havens

Posted November. 08, 2024 08:35,

Updated November. 08, 2024 08:35

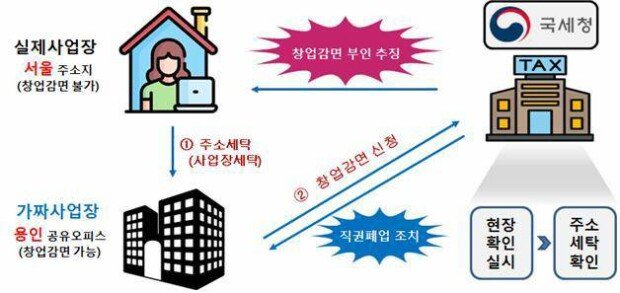

A YouTuber identified as "A," based in Seoul, set up a "ghost office" in a shared office space in Yongin, Gyeonggi Province, after discovering that young entrepreneurs in rural areas could receive a five-year income tax exemption. Through this setup, A avoided taxes amounting to billions of won. The National Tax Service (NTS) has since canceled A's business registration and announced plans to reclaim the tax benefits A received.

According to the NTS on Thursday, 2,900 corporations and 649 individuals misused similar tax credit and exemption schemes last year, reaping unfair tax benefits. The NTS collected a total of 174.9 billion won in unpaid taxes from these cases. In 2021 and 2022, the agency collected 54.4 billion won and 71.2 billion won, respectively, but tax evasion activities surged last year, resulting in higher tax recoveries.

A significant number of cases involved YouTubers and online vendors falsely registering businesses in non-metropolitan areas. They exploited a tax benefit program offering a 100% income tax exemption for five years to small businesses in regions outside the capital's restricted zone.

At the shared office A used, over 1,400 businesses were registered within a 1,322-square-meter building, effectively giving each business an average of less than just 1 square meter. When the NTS inspected the location, it found a single empty room registered to 177 businesses, with piles of abandoned mail, indicating clear signs of address laundering. A similar case was found in Songdo, where a shared office space of comparable size housed over 1,300 registered businesses. The NTS has formed a task force to monitor these "domestic tax havens" within shared office spaces in rural areas. The team will assess whether businesses registered at these locations are actually operational.

세종=송혜미 1am@donga.com

Headline News

- Opposition parties pass amendment to Commercial Act

- Impeachment motions against top officials dismissed

- IU's residence ranked as the nation's most expensive apartment

- K-medicine saves 300 lives in Mongolia through liver transplant skill transfer

- Prisoners in N. Korean camps suffer from torture at minus 30 degrees