A future that seemed distant may be closer than we think

A future that seemed distant may be closer than we think

Posted November. 30, 2024 07:27,

Updated November. 30, 2024 07:27

“The future believed to be near turned out to be more distant than expected while the future once thought to be far away was nearer than expected.”

That is the statement shared with the management by Chairman Chang-won Choi of SK SUPEX Council, currently leading the restructuring of Korea's second-largest business group. The EV boom, which seemed within reach, has receded due to the mass market downturn, but AI, which seemed as surreal as the blockbuster Iron Man, has dominated Korea's industrial landscape throughout the year 2024.

Welcoming yet another yearend, the difficulty of predicting even one or two years becomes increasingly clear. With last week's bankruptcy of Sweden’s Northvolt, Europe's largest EV battery manufacturer, investors including Goldman Sachs and Volkswagen could suffer losses worth one trillion won. The Financial Times noted that Europe's best-funded private start-up had just cash enough for a week's operations and 5.8 billion U.S. dollars in debt.

Korea's major companies in two pillar industries, EV batteries, and semiconductors, spent a starkly contrasting year. In May 2023, when three major battery manufacturers announced plans for building plants in North America, market analyst SNE Research forecasted annual growth of EV batteries by 63% in the U.S. and 30% in Europe. The same market research company predicted the EV battery market growth (excluding China) by a mere 12.5% after accumulating the data until September 2024. By contrast, memory semiconductor businesses for both Samsung and SK Group, which have been suffering from trillion-won-worth debts until the third quarter of 2023, rebounded with the AI-driven semiconductor boom this year.

Behind the scenes, these shifts were even more dramatic. SK hynix's NAND flash business, acquired from Intel for 10 trillion won and now operating as Solidigm, recorded a 4 trillion won loss last year. This sparked internal disputes over investment accountability, and there was even discussion of repurposing its idle Kioxia NAND production lines for high-bandwidth memory (HBM). However, within a year, the NAND business made a splendid comeback, with the AI server market in full bloom. Chairman Chey Tae-won chaired the board of Solidigm himself.

Just a year ago, nobody expected the change of fate in EV batteries and semiconductors. One thing always remains true though: when the wave of change comes, there is always the No.1 principle that determines between survival and downfall: Companies that wish to survive at the risk of failure need to be flexible enough to steer and sail with the tailwind, bold to throw away excessive stack of freight and thorough to check any loose point on freight lashing.

Secondly, the role of the government and the legislature is the help these companies need while going through the waves after their survival. Korea's semiconductor industry is in a slightly better position than Korea's EV battery makers in that the ruling party, in general, is advancing special legislation for semiconductors. Korean battery companies, struggling with deficits, are not even getting the cut in corporate tax. China's CATL, one of the largest competitors in business, is quickly growing with the help of government subsidies, surpassing 700 billion won in just the first half of the year.

As he stepped down, Northvolt CEO Peter Carlsson, formerly of Tesla, left a parting message to politicians, businesses, and investors that they will regret if they shun away from green transition. We should start preparing immediately for the next opportunity if we do not want to regret and say that the distant-looking future was nearer than we thought.

Headline News

- ‘Korean THAAD’ L-SAM successfully developed in 10 years

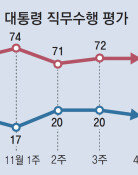

- Pres. Yoon’s approval rating falls back to 10% range

- ‘Commercial Code amendments could harm capital market amid uncertainty’

- Prosecutors conduct search and seizure for industrial complex intervention allegations

- Democratic Party pushes amendment for special prosecutor