‘Commercial Code amendments could harm capital market amid uncertainty’

‘Commercial Code amendments could harm capital market amid uncertainty’

Posted November. 30, 2024 07:28,

Updated November. 30, 2024 07:28

"Amendments to the Commercial Code will not help the development of the capital market and will instead undermine corporate growth."

On Friday morning, the business community met with members of the Democratic Party of Korea at the Korea Chamber of Commerce and Industry (KCCI) in Jung-gu, Seoul, and expressed their concerns about the recent proposed amendments to the Commercial Code that the opposition party is pushing as its official stance. The proposed amendments, which include expanding the scope of directors' duty of loyalty, could impose new restrictions on corporate activities, leading to a significant downturn in business operations if the bill is passed as is.

The 'Democratic Party's Stock Market Activation Task Force' held a meeting with the business community at KCCI to listen to concerns and suggestions about the proposed amendments to the Commercial Code. In attendance were 11 Democratic Party lawmakers, including Policy Committee Chair Jin Seong-jun, and 14 representatives from seven business organizations and seven companies. Park Il-jun, KCCI's executive vice chairman, stated in his opening remarks, "Uncertainty for businesses is increasing, and small and medium-sized enterprises (SMEs) and small businesses, as well as advanced industries, are facing significant difficulties. There are also growing concerns about the amendments to the Commercial Code."

The meeting, which was scheduled to last for one hour starting at 10:50 a.m., went over by 40 minutes and concluded at 12:30 p.m. The Democratic Party noted that the meeting ran long because they listened to the presentations from the seven companies and seven organizations without time restrictions.

The business representatives raised concerns that if the duty of loyalty for directors is expanded from just the company to include shareholders, the incentives for companies to go public will decrease, which could shrink the stock market. They also argued that it takes about 10 years for business decisions to lead to results, but the three-year term for directors could result in short-sighted decisions.

Some also pointed out that mid-sized and small companies, which make up 86% of listed companies, could be the hardest hit by these changes. Only about a third of mid-sized companies have legal departments, and small businesses typically have CEOs managing nearly all aspects of the business, making it difficult for them to manage the changes. Other topics discussed included the potential for excessive litigation tying up business operations in court and the need to abolish the crime of embezzlement.

박현익 기자 beepark@donga.com

Headline News

- ‘Korean THAAD’ L-SAM successfully developed in 10 years

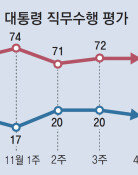

- Pres. Yoon’s approval rating falls back to 10% range

- ‘Commercial Code amendments could harm capital market amid uncertainty’

- Prosecutors conduct search and seizure for industrial complex intervention allegations

- Democratic Party pushes amendment for special prosecutor