Consumer sentiment hit by aftermath of martial law

Consumer sentiment hit by aftermath of martial law

Posted December. 25, 2024 07:48,

Updated December. 25, 2024 07:48

Consumer sentiment at the end of the year froze rapidly amid anxiety over the political situation following the martial law declaration. The self-employed, who were hit hard by the domestic economic slowdown, were impacted by debt burdens due to declining income and credit rating.

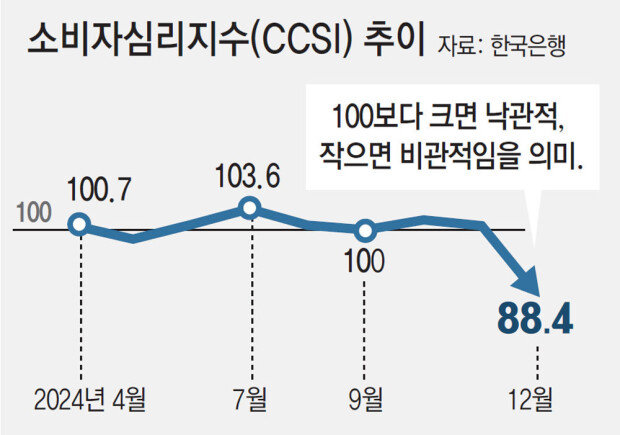

According to the Bank of Korea’s ‘December Consumer Trend Survey Results’ on Tuesday, the Consumer Sentiment Index (CCSI) was 88.4, down 12.3 points from November, the largest decline since March 2020 (-18.3 points) at the onset of the pandemic. The index itself has also been at its lowest level in two years and one month since November 2022 (86.6). CCSI is an indicator of consumer sentiment of the overall economic situation. A value higher than 100 is considered optimistic, while lower than 100 is pessimistic. It had remained above 100 until last month (100.7) but fell significantly due to continued political unrest after martial law was declared on Dec 3. Current economic judgment (52) and future economic outlook (56), which are factors included in the index, plummeted respectively by 18 points compared to the previous month.

“Consumer sentiment index fell in November due to concerns of a slowdown in exports following the results of the U.S. presidential election. The martial law situation earlier this month was added as a factor in the index decline.”

“The consumer sentiment index fell in November due to concerns about a slowdown in exports following the results of the U.S. presidential election,” said Hwang Hee-jin, head of the statistical research team at the Bank of Korea. “The declaration of martial law earlier this month further weighed down the decline.”

Such an abrupt decline in consumer sentiment is expected to further push the self-employed, who are already pushed to their limit due to sluggish domestic demand. According to the Bank of Korea's financial stability report on Tuesday, the loan delinquency rate for the self-employed at the end of the third quarter of this year was 1.70%, the highest in nine years since the first quarter of 2015 (2.05%). In particular, the loan delinquency rate of vulnerable self-employed reached 11.55%, the highest in 11 years since the third quarter of 2013 (12.02%). Among the self-employed with middle income and medium credit or above, the number of people who fell into the low-income class (lower 30% or less in income) reached 22,000, while the number of the self-employed with low credit increased by 56,000 this year.

이동훈 기자 dhlee@donga.com